The Property By Helander Llc PDFs

The Property By Helander Llc PDFs

Blog Article

Getting The Property By Helander Llc To Work

Table of ContentsAbout Property By Helander LlcGetting My Property By Helander Llc To WorkThe smart Trick of Property By Helander Llc That Nobody is DiscussingRumored Buzz on Property By Helander Llc

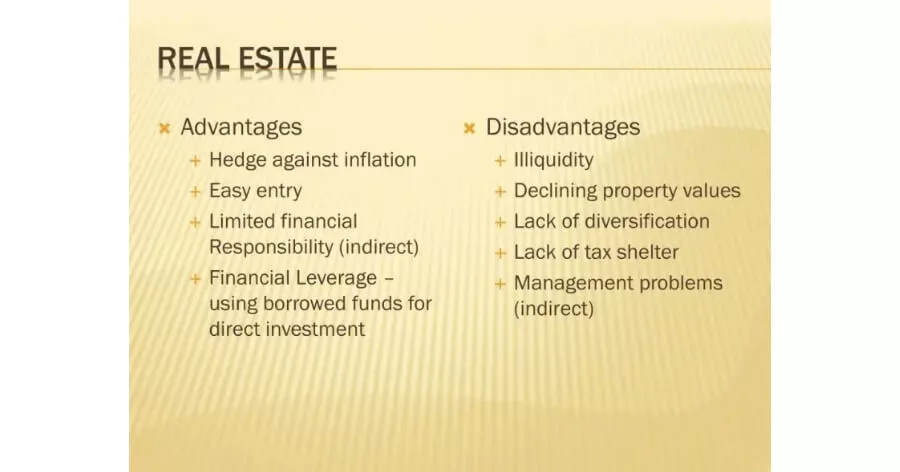

The distinction in between the price and the rate you paid to buy will be the resources gain, which will certainly be taxed, yet only in the year that you throw away the building. Actual estate isn't based on the same volatility as other sort of investments. Unlike stock trading, the property market isn't like to have the very same substantial overnight changes.It's a great enhancement to a more risk-averse profile, making it an all-around fantastic investment! It's vital to keep in mind that genuine estate investment doesn't come without danger. The United States housing market collision of 2008 showed investors the significance of not over-leveraging and making smart financial investment decisions when expanding their profiles.

Rental revenue apart, actual estate builds up passive riches via its fundamental tax advantages and long-lasting appreciation. With the right building managers and rental team, the ROI on your financial investment becomes reasonably easy.

The 10-Minute Rule for Property By Helander Llc

Below at BuyProperly, we utilize a fractional possession version to enable capitalists to buy actual estate for as little as $2500. ****Call to activity right here *******In enhancement to monetary prices, spending in actual estate comes with a substantial time expense when you take into account sourcing home dealsUnlike buying and trading stocks which can be done with the click of a mouse, property investment typically needs even more time, research, and preparation. Sandpoint Idaho land for sale.

In addition to this, if you don't have a good group in position, managing your repair work, upkeep, and tenants can turn right into an overwhelming procedure. Sourcing great deals doesn't have to be complicated. At BuyProperly, for instance, we've developed an AI-powered system that permits capitalists to see, buy, and sell realty digitally (just like they would certainly trade supplies).

As much as we like genuine estate for its security and foreseeable returns, it's not the type of financial investment that can be dealt rapidly. The greatest returns are earned when capitalists are prepared to buy and hold. If you assume you may need to liberate cash money swiftly, OR if you're looking for a remarkably quick revenue, realty may not be your primary investment automobile

4 Easy Facts About Property By Helander Llc Described

Along with cash flow possibility, you can additionally take advantage of constant admiration, reduced volatility, and capitalist tax advantages. It is necessary to keep in mind that genuine estate is a superb long-lasting investment, and not well matched to individuals who desire immediate returns. It's a trustworthy, go right here foreseeable property with excellent cash circulation and ROI possibility.

One of the largest benefits of property investing is its passive earnings. (https://www.startus.cc/company/property-helander-llc) opportunities. You can use the revenue made to construct a bigger actual estate portfolio, pay month-to-month expenditures or save for other economic goals. A few ways to gain easy revenue with realty financial investments include:: When you lease residential properties, you make passive revenue.

The internal revenue service enables capitalists to subtract expenses involved in their property organization if they can verify material engagement. The costs you may be qualified to deduct consist of the following:: If you finance investment residential properties, you might be able to deduct the rate of interest paid on the mortgage.: Investor can typically subtract devaluation for domestic and business properties over their valuable life (27.5 years and 39 years, specifically).

Some Of Property By Helander Llc

This enables you to increase your real estate profile by spending even more resources. To access the funding, you can sell the building and reinvest the funds in one more residential property or make use of a cash-out re-finance to access some of the home's equity, supplying you with more funding to raise your genuine estate profile, making more income.

Genuine estate, however, provides a bush versus rising cost of living due to the fact that as rising cost of living rates increase, so do realty costs commonly. This permits your financial investment to keep rate with rising cost of living and you to keep the power of the dollar. Leveraging your real estate financial investment is one of the ideal advantages of property investing.

You must check out the prospectus (Sandpoint Idaho real estate) meticulously for a description of the dangers connected with a financial investment in JLL Revenue Property Trust. A few of these threats consist of however are not limited to the following: Given that there is no public trading market for shares of our ordinary shares, repurchases of shares by us after a 1 year minimum holding duration will likely be the only means to take care of your shares

Report this page